Irs 2025 Standard Deductions And Tax Brackets

Irs 2025 Standard Deductions And Tax Brackets. And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of $1,100 from the. For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025;

And the standard deduction for heads of. The internal revenue service (irs) adjusts tax brackets for inflation each year, and because inflation remains high, it’s possible you could fall into a lower bracket for the income you earn in 2025.

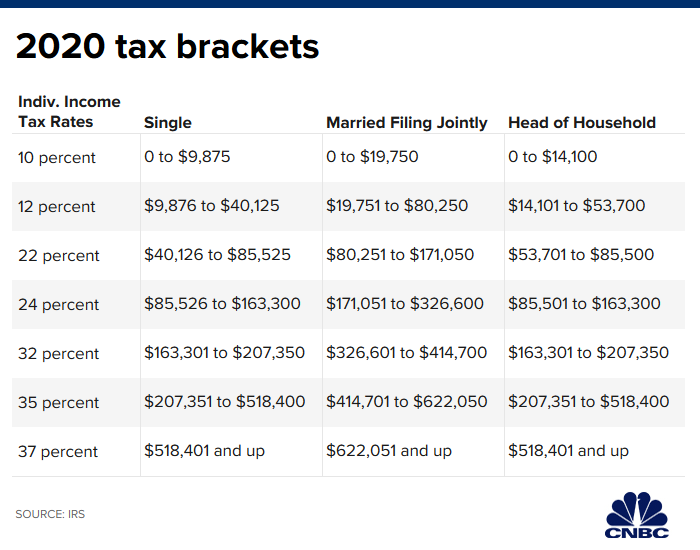

2025 Standard Deduction Over 65 Tax Brackets Leann Myrilla, 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

2025 Tax Brackets And Standard Deduction Table Cate Marysa, The highest earners fall into the 37% range, while those who earn the least are in.

2025 tax brackets Archives Optima Tax Relief, The 2025 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2025 tax.

Standard Federal Tax Deduction For 2025 Cati Mattie, The irs will publish the official tax brackets and other tax numbers for 2025 later this year, likely in october.

Oct 19 IRS Here are the new tax brackets for 2025, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

2025 Standard Deductions And Tax Brackets Pippa Britteny, For comparison, the standard deduction amounts for single taxpayers and married taxpayers filing separately was $14,600 in 2025.

2025 Standard Deductions And Tax Brackets Irs Celia Darelle, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025;

2025 Standard Deduction Married Joint Irs Alexi Austina, The irs will publish the official tax brackets and other tax numbers for 2025 later this year, likely in october.

Tax Brackets 2025 Standard Deduction Jewel Lurette, The standard deduction for single filers and for married people who file separate returns rises to $14,600, up $750 from 2025;